Regional market analysis

The recent increase in global kiwiberry production suggests the existence of unmet demand, yet the fruit remains unfamiliar to most consumers. With no regional data available regarding consumer acceptance and demand for this novel crop, New England growers interested in kiwiberries as a potential enterprise have essentially no information upon which to base production decisions, develop enterprise budgets, or formulate marketing strategies. To address this basic lack of regionally-relevant market information, NHAES researchers conducted a statewide survey of farmers market customers to determine consumer acceptance of and willingness to pay for kiwiberries in the Granite State.

Supported by a USDA Rural Business Development Grant, a local market assessment was undertaken in the fall of 2016 to establish a statistically relevant benchmark of demand in NH for locally grown kiwiberries. At 22 farmers markets across the state, market attendees were invited to sample a kiwiberry and complete a short survey form, providing written feedback regarding trait preferences and acceptable price point for a 6 oz. clamshell of fresh kiwiberries (for more details, see Appendix III ‘Market analysis methodology and results’).

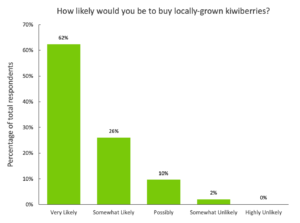

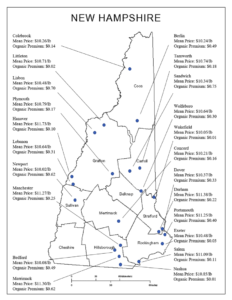

In total, written responses were obtained from 1,999 customers, more than five times the number required to achieve the desired level of confidence (95%) for the target population. Of those respondents, 62% indicated they would be “very likely” to purchase regionally grown kiwiberries in the future (Fig 8). Statewide, the average price respondents were willing to pay was $10.64/lb ($3.99 per 6 oz. clamshell) for grade A fruit, meaning berries of uniform size and free of cosmetic blemishes and defects. On average, organic fruit commanded a slightly higher perceived value of $11.23/lb ($4.21 per 6 oz. clamshell). Market-by-market results are shown in Fig 9.

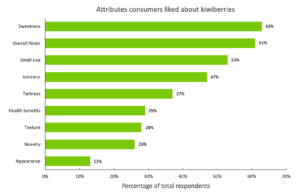

To help guide research priorities for the NHAES kiwiberry breeding program and inform marketing strategies, survey participants were also asked to indicate which attributes of the kiwiberry they particularly liked or disliked. Approximately 95% of the survey respondents indicated some attribute they particularly liked (Fig 10). In general, consumers prized sweetness, overall flavor, juiciness, and small size above other attributes (63%, 62%, 53%, and 47% of total respondents, respectively).

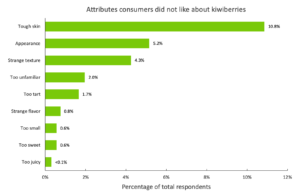

Of the 1,999 respondents, approximately 25% indicated at least one attribute of the kiwiberry they did not like. Rising to the top of that list (11% of total respondents) was the perceived toughness, or chewiness, of the skin. Dislike of either the overall appearance (e.g. blemishes) or the unfamiliar texture followed, at 5% and 4% of total respondents, respectively. Other traits were noted at lower frequency (Fig 11), at least some of which are likely due to variation in ripeness among the berries sampled (e.g. skin, texture, juiciness, and flavor).

Based on these survey results, the NHAES kiwiberry breeding program is focusing its attention on developing new varieties with improved berry uniformity (size and ripening), texture, cosmetic appearance, and nutritional aspects while preserving the overall flavor profile (sweet-acid balance) in a bite-sized fruit. The consumer willingness-to-pay data were also used to develop the regional kiwiberry enterprise analysis featured in this guide.